Carbon Assessment Reports

How can a Carbon Assessment Report support your transaction?

An initial upfront embodied Carbon Assessment Report undertaken during the due diligence phase of purchasing a commercial property, offers several important benefits related to environmental sustainability, risk assessment, and overall property value.

- Comprehensive Due Diligence: A streamlined embodied Carbon Assessment Report adds depth to your due diligence process, providing a well-rounded view of the property’s potential risks and opportunities.

- Environmental Responsibility: By assessing the embodied carbon of a property, you demonstrate a commitment to understanding and minimising the environmental impact of your investment. This aligns with global efforts to reduce carbon emissions and mitigate climate change.

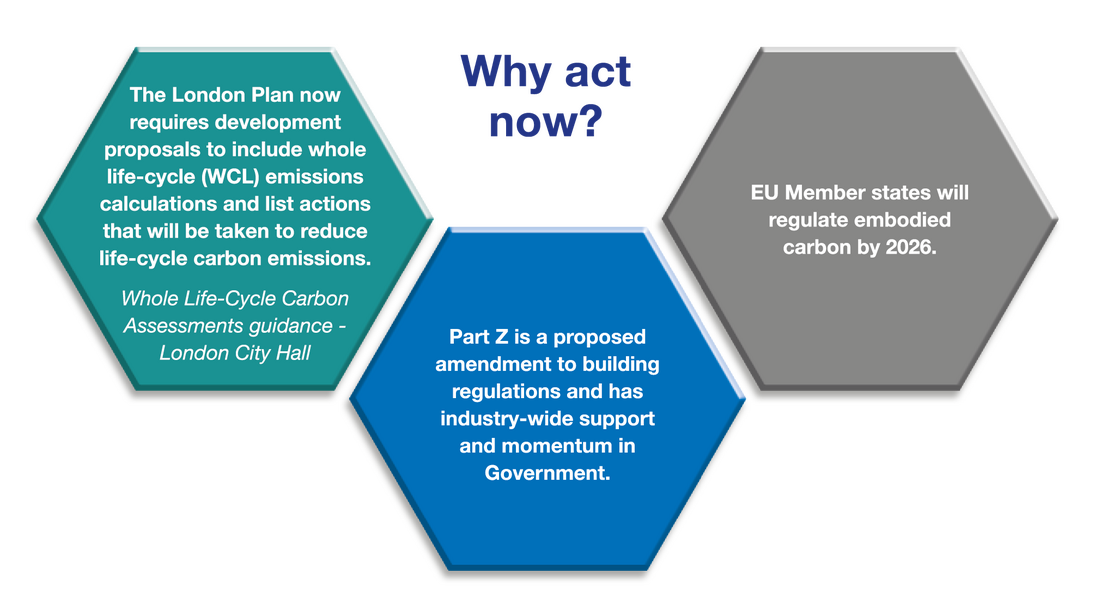

- Regulatory Compliance: Many regions are introducing regulations and standards related to building emissions and sustainability.

A streamlined embodied Carbon Assessment Report could go some way to ensuring your potential property complies with current and future environmental regulations, reducing the risk of legal issues.

Risk Mitigation

Understanding the embodied carbon of a property can highlight potential financial and operational risks. Properties with high embodied carbon might be more vulnerable to future carbon pricing, regulatory changes, and shifts in market demand for sustainable buildings.

Investor and Stakeholder Expectations

Many investors, particularly those focused on environmental, social, and governance (ESG) factors, expect companies to incorporate sustainability considerations into their investment decisions. Having an embodied Carbon Assessment Report helps meet these expectations.

Responsible Reputation

Incorporating sustainability considerations into due diligence enhances your reputation as a responsible investor or organisation, which can lead to positive PR and stakeholder goodwill.

Negotiation Leverage

Armed with data on the embodied carbon of a property, you can negotiate from an informed standpoint. You might be able to secure better terms or even lower the purchase price if the report reveals potential sustainability challenges.

Although it is an ‘upfront’ embodied Carbon Assessment Report, incorporating the detail into your due diligence process demonstrates a forward-thinking approach that considers both environmental impact and financial sustainability. It helps you make well-informed investment decisions that align with both your financial goals and broader sustainability objectives.

Why Plowman Craven?

Plowman Craven is integral in the due diligence process, providing accurate area reports and, as part of the exercise, we can arrange to collect additional information to support the generation of a streamlined embodied Carbon Assessment Report, supported by our long-established environmental team.

What does the Carbon Report contain?

The report aims to assess the ‘upfront’ embodied carbon and focuses on the embodied carbon to practical completion which, as defined by RICS, comprises stages A1 to A5 of the EN 15978 introduced modular approach. Using specialist and market leading software, the report provides embodied carbon emissions at each stage, with pictorial material breakdowns, a final total and value per unit floor area.

Can Plowman Craven provide a more comprehensive Full Lifecycle Assessment (LCA) report?

Whilst the streamlined embodied Carbon Assessment Report provides a quick upfront view, you may desire a deeper understanding of your asset.

A comprehensive LCA carbon report requires careful data collection, robust methodologies, and consideration of various environmental impacts. It helps organisations make informed decisions to minimise their carbon footprint and contribute to more sustainable practices. Our environmental team at Plowman Craven can provide the consultative advice and direction towards achieving this assessment.

How Can We Help?

Let’s discuss your requirements and see how our expertise in Carbon Assessment Reports can help on your next project.

Plowman Craven has 60 years’ experience providing integrated measurement and consultancy services to the property and infrastructure markets.